In the dynamic and often unpredictable world of business, financial management stands as a cornerstone of success. Whether you are an aspiring entrepreneur or a seasoned small business owner, understanding and mastering key financial activities can make the difference between thriving and merely surviving. This guide is designed to walk you through the essential components of business finance, providing practical insights and strategies to help you navigate the financial landscape with confidence.

- Unlocking Efficiency: How Activity-Based Management (ABM) Boosts Profitability and Performance

- Mastering Always Be Closing (ABC): The Ultimate Sales Strategy for Modern Business

- Mastering Batch Processing: Efficiency and Cost Savings in Finance, Business, and Investment

- Unlock Stable Returns: What Are Blue-Chip Stocks and Why You Should Invest

- How to Become an Accredited Investor: Eligibility Criteria and Benefits

Understanding the Fundamentals of Business Finance

Financial statements are the backbone of any business’s financial health. Here are three crucial statements you need to understand:

Bạn đang xem: Unlocking Business Success: A Comprehensive Guide to Key Business Activities

Balance Sheet

The Balance Sheet provides a snapshot of your company’s financial condition at a specific point in time. It includes assets (what your business owns), liabilities (what your business owes), and owner’s equity (the owner’s stake in the business). This statement gives you a clear picture of your company’s overall financial health.

Income Statement

The Income Statement, also known as the Profit & Loss Statement, reflects your business’s operational performance over a specific period. It shows revenue, expenses, and net income, giving you insights into how well your business is performing from an operational standpoint.

Cash Flow Statement

The Cash Flow Statement tracks the inflow and outflow of cash within your business, highlighting liquidity and cash availability. It is divided into three main sections: operating activities, investing activities, and financing activities. This statement helps you understand where your cash is coming from and where it is going.

Financial literacy is paramount for business owners. It allows you to make informed decisions, manage resources effectively, and ensure long-term sustainability.

Budgeting for Success

Creating a comprehensive budget is a critical step in guiding your business towards financial stability and growth.

Assessing Income and Expenses

Start by assessing your expected income and foreseeable expenses. This involves projecting revenue based on historical data and market trends, as well as estimating fixed and variable costs.

Setting Financial Targets

Set clear financial targets that align with your business goals. These targets could include revenue growth, profit margins, or specific expense reductions. Regularly measure your performance against these goals to ensure you are on track.

Allocating Resources Efficiently

Budgeting helps in allocating resources efficiently by prioritizing spending based on business needs. It also helps in identifying potential financial shortfalls early on, allowing you to take corrective actions before they become major issues.

Cash Flow Management

Cash flow management is vital for the survival and growth of any business.

Tracking and Forecasting Cash Needs

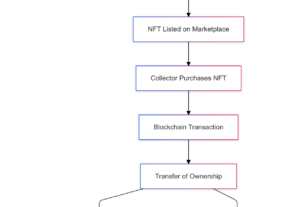

Xem thêm : What is NFT Marketplace? – ZCrypto

Regularly track your cash inflows and outflows to understand your cash flow patterns. Use historical data and market trends to forecast future cash needs. This helps in anticipating liquidity issues before they arise.

Cash Burn Rate

For startups and growth-phase businesses, understanding the cash burn rate is crucial. This rate indicates how quickly your business is using up its cash reserves. Managing this rate effectively ensures that you have enough cash to meet upcoming expenses and investments.

Maintaining Consistent Cash Flow

To maintain a consistent cash flow, focus on managing accounts receivable and payable efficiently, optimizing inventory levels, and ensuring timely payments from customers. These strategies help in keeping a steady flow of cash into your business.

Financial Planning and Forecasting

Integrated financial planning is essential within the overall company planning process.

Tactical vs. Strategic Planning

Financial planning can be divided into two main time frames: tactical planning (2-5 years) and strategic planning (more than 5 years). Tactical planning focuses on short-term goals such as expanding product lines or entering new markets, while strategic planning looks at long-term objectives like market dominance or diversification.

Developing a Detailed Financial Plan

Develop a detailed financial plan for the first year and update it quarterly or annually thereafter. This plan should include projected revenues, expenses, profits, and cash flows based on historical data, market trends, and future projections.

Financial Forecasting

Use financial forecasting to anticipate future financial needs. Analyze historical data, industry trends, and economic conditions to predict future revenues and expenses. This helps in making informed decisions about investments, expansions, and resource allocation.

Investment and Growth Strategies

Investing wisely is key to business expansion and growth.

Reinvesting Profits

One of the most common investment strategies is reinvesting profits back into the business. This could be in the form of expanding operations, investing in research and development, or enhancing marketing efforts.

External Funding

Seeking external funding through loans or equity investments can also fuel growth. However, it’s important to analyze potential returns on investment carefully before making any decisions.

Risk Management

Implement risk management strategies to mitigate financial risks. This includes setting aside reserves for unexpected expenses, diversifying income sources to reduce dependency on a single revenue stream, and obtaining appropriate insurance coverage.

Financing Options

Xem thêm : Mastering a Balanced Investment Strategy: Expert Tips for Optimal Returns

Businesses have several financing options available:

Debt Financing

Debt financing involves borrowing money from lenders with no loss of control or ownership. It offers predictable monthly payments and tax-deductible interest but requires regular repayments.

Equity Financing

Equity financing involves selling shares of your company to investors. While it provides more liquid cash for operating expenses without monthly payments, it involves giving up ownership and control.

Mezzanine Financing

Mezzanine financing combines elements of debt and equity financing. It typically includes a loan with an equity component that can convert into shares if repayment terms are not met.

Each option has its advantages and disadvantages; choosing the right one depends on your business needs and financial situation.

Managing Business Debts

Managing business debts effectively is crucial for sustainable growth.

Good vs. Bad Debt

Differentiate between good debt (e.g., loans for expansion) and bad debt (e.g., high-interest credit card debt). Good debt can fuel growth while bad debt can lead to financial distress.

Strategies for Repayment

Understand the terms and conditions of your loans, prioritize high-interest debts first, and maintain a consistent repayment schedule. Regularly reviewing your debt portfolio helps in making adjustments as needed.

Continuous Review and Adaptation

Financial strategies should not be static; they need to adapt to changing market conditions and internal factors.

Regular Financial Reviews

Continuously review your financial performance to stay on track with your objectives. Use this data to identify areas needing improvement or opportunities for growth.

Adapting Strategies

Be prepared to adapt your financial strategies in response to market changes or internal factors such as changes in consumer demand or economic conditions. This adaptability ensures that your business remains competitive and resilient.

Nguồn: https://gapinsurance.click

Danh mục: Blog