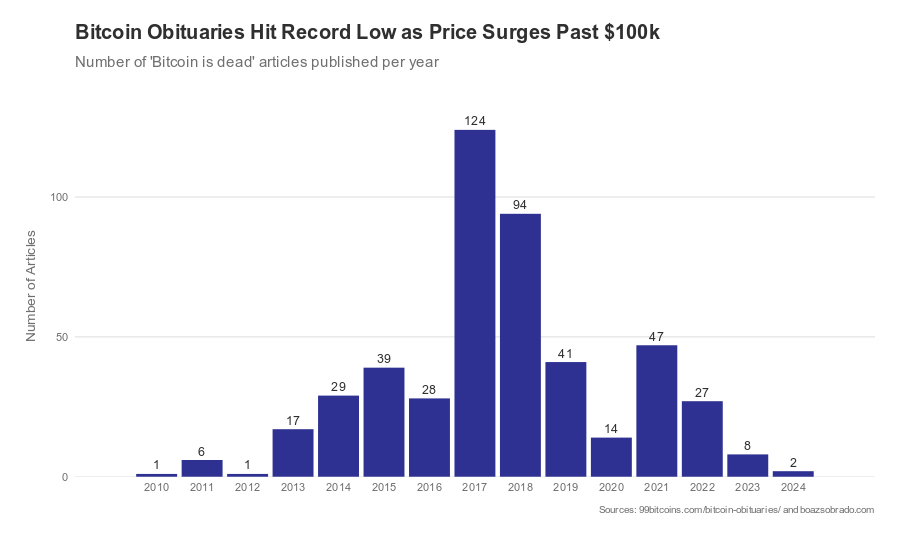

The chart tracks the frequency of “Bitcoin obituaries” – articles declaring Bitcoin’s demise – from … [+]

Bạn đang xem: The Year Crypto Silenced Its Critics? The Numbers Tell All

After Donald Trump’s election in 2024, an unexpected moment of candor emerged from an unlikely source. On their long-running Crypto Critics’ Corner podcast, Cas Piancey and Bennett Tomlin—two of cryptocurrency’s most well informed skeptics—made a striking admission. After years of investigating and criticizing Tether and the broader crypto ecosystem, they conceded that their long-predicted regulatory crackdown was unlikely to materialize. In their words “They win, we lose”.

Dearth of Obituaries

This moment of capitulation from prominent critics wasn’t an isolated incident. At 99Bitcoins, a website that has diligently tracked Bitcoin’s “death” pronouncements since 2010, the editors found themselves with surprisingly little to do in 2024. Their “Bitcoin obituaries” counter, which records major declarations of Bitcoin’s demise by media and notable figures, recorded just two such pronouncements all year: the lowest number since 2012.

Xem thêm : Hawk Thua Girl Breaks Silence After Devastating $HAWK Cryptocurrency Crash

The pattern is striking. Bitcoin obituaries peaked in 2017 with 124 declarations of its death, coinciding with its first major price surge. Another surge appeared in 2021-2022 during Bitcoin’s second major bull run and the subsequent FTX collapse. But 2024’s mere two obituaries mark a shift in perception.

Bitcoin ETF : Breaking All Records

The Bitcoin ETF approval has a lot to do with this. The launch of Bitcoin ETFs in March 2024 didn’t just mark a regulatory milestone, it unleashed an unprecedented wave of institutional adoption. BlackRock’s iShares Bitcoin Trust, in particular, shattered every previous ETF launch record. Reaching $10 billion in assets under management in just seven weeks, it accomplished what took the previous record-holder, SPDR Gold Shares, two years to achieve. By the end of 2024, the iShares Bitcoin Trust had accumulated over $50 billion in assets under management—a stunning achievement in just 11 months.

The first day of trading alone saw volumes exceeding $4.65 billion, signalling massive pent-up demand from both institutional and retail investors. With total net assets over $106 billion, these Bitcoin ETFs aren’t just successful: they’re approaching the scale of gold ETFs that have been established for decades. This isn’t merely adoption; it’s a wholesale transformation of how traditional finance views and accesses cryptocurrency.

Larry Fink’s evolution from crypto skeptic to champion perfectly embodies this transformation. The BlackRock CEO’s journey from dismissing Bitcoin as a money laundering tool to overseeing one of the most successful ETF launches in financial history represents the broader institutional acceptance of cryptocurrency as a legitimate asset class.

Bitcoin has Entered Mainstream Politics

Xem thêm : What is the Best Cryptocurrency to Buy Right Now? 10 Best Crypto Coins to Invest in for 2025

The transformation in the political sphere has been equally dramatic. Donald Trump, once a cryptocurrency skeptic who described Bitcoin as “a scam against the dollar” in 2021, has emerged as a powerful voice in the crypto space. His appearance at the Bitcoin 2024 Conference marked a key moment in cryptocurrency’s global political legitimacy. The selection of JD Vance, a well-known crypto advocate, as his vice presidential candidate further signalled cryptocurrency’s emergence as a serious policy consideration.

Perhaps most significantly, the conversation in Washington has evolved from regulatory skepticism to strategic opportunity. The discussion of a Bitcoin Strategic Reserve in the U.S. Senate – unthinkable just a few years ago – represents a fundamental shift in how government officials view cryptocurrency’s role in the national economy. This isn’t just about accepting crypto’s existence; it’s about potentially integrating it into national financial strategy.

Beyond Bitcoin: The Broader Crypto Evolution

This acceptance isn’t limited to Bitcoin. Stablecoins, backed by major financial institutions and payment processors like Stripe, are processing transaction volumes comparable to traditional payment networks like Visa. This represents a fundamental innovation in payment technology that’s becoming impossible to ignore.

The steep decline in Bitcoin obituaries in 2024 isn’t just a statistical curiosity. It’s a marker of cryptocurrency’s transition from a speculative phenomenon to an established part of the financial landscape. The question is no longer whether crypto will survive, but how it will evolve and integrate with traditional financial systems.

The editors at 99Bitcoins might find themselves even less busy in the years to come, but they’ve documented something remarkable: the year when cryptocurrency’s critics had to accept that crypto is here to stay.

Nguồn: https://gapinsurance.click

Danh mục: News