- Cryptocurrency Market Trends, Industry Developments, and

- Rise in cryptocurrency fraud creates opportunities for the insurance industry

- International energy firm gears up to start mining dogecoin — here’s what it plans to do with the cryptocurrency

- BexBack Announces Fee-Free USDT-to-BTC Conversion and 100%

- Hawk Tuah Girl Is ‘Casting Herself as Victim’ in Crypto Crash—Lawyer

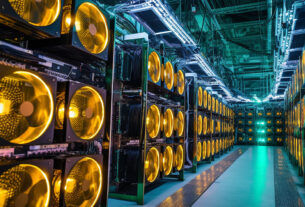

KuCoin introduced a solution designed to bring cryptocurrency payments into the retail sector.

Bạn đang xem: KuCoin Debuts Crypto Payment Acceptance Tool for Merchants

The digital asset exchange’s KuCoin Pay aims to bridge “ the gap between traditional retail and crypto, offering contactless and borderless transactions,” according to a news release Thursday (Jan. 2).

“Leveraging KuCoin’s robust infrastructure — trusted globally and serving over 37 million users — KuCoin Pay is poised to open new opportunities for merchants and users to thrive in the evolving digital economy,” the release said.

Xem thêm : Could 2025 be another game changing year for Bitcoin and other cryptocurrencies?

The platform supports a range of cryptocurrencies and blockchain networks, letting customers complete purchases via KuCoin — once integrated into a merchant’s payment system — by scanning a QR code or using the KuCoin app, per the release.

The integration with the app allows “businesses to tap into KuCoin’s … user base while simplifying the buying process for everyday items for users,” the release said. “Daily requests such as gift cards and mobile top-ups can be done seamlessly, further promoting widespread crypto adoption.”

Stablecoins — cryptocurrencies pegged to stable assets like fiat currencies — are a viable medium for international transactions. PayPal and Circle, for example, launched their own stablecoins to modernize cross-border remittances and B2B transactions.

The PYMNTS Intelligence report “Can Blockchain Solve the Cross-Border Payments Puzzle?” examined how blockchain could revolutionize cross-border payments, explored its current adoption and looked at the future implications for financial institutions and businesses.

Xem thêm : Beverly Hills man charged in cryptocurrency scam

Stablecoins provide near-instant settlement and lower transaction costs, but challenges like regulatory clarity that changes from jurisdiction to jurisdiction remain, creating obstacles to widespread adoption.

Meanwhile, crypto payments remain uncharted territory for many consumers.

“Businesses should clearly communicate the steps involved, including which cryptocurrencies are accepted and any applicable fees,” PYMNTS reported in November. “Offering educational resources or support channels can ease customer adoption.”

As crypto adoption grows, remaining abreast of regulatory changes is also something that could be crucial for consumers and merchants.

“The main barrier to widespread stablecoin adoption outside of the crypto ecosystem is the lack of regulatory frameworks,” Tony McLaughlin, emerging payments at Citi Services, told PYMNTS in November.

Nguồn: https://gapinsurance.click

Danh mục: News