- SOL and ETH set the horizon! Exploring new cryptocurrency could explode by summer 2025 with growth over 1,500%.

- Fed’s Anti-Bitcoin Stance Triggers Major Crypto Market Sell-off

- Hawk Tuah Girl Releases Statement About Crypto Lawsuit

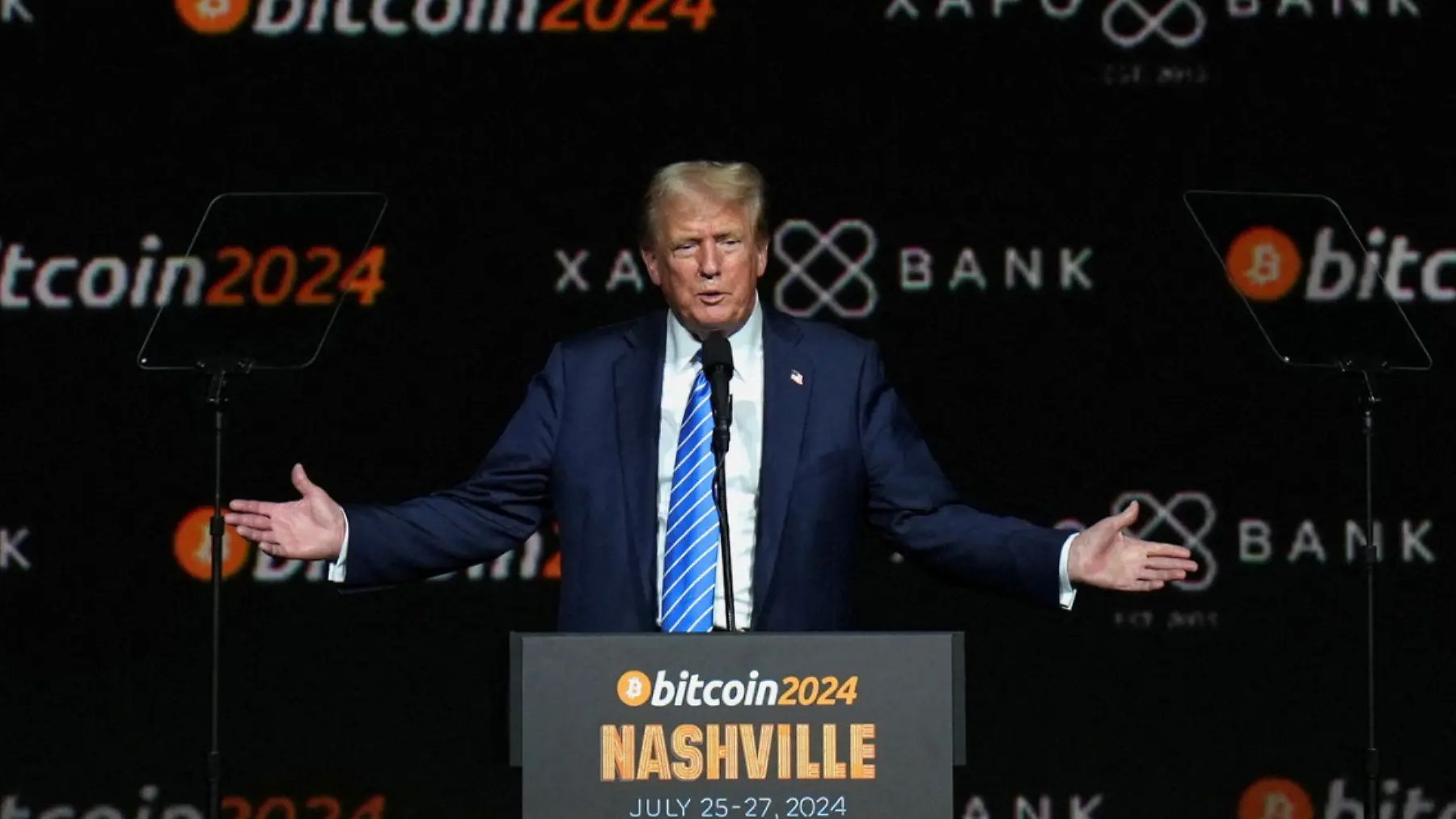

- Bitcoin soars to new all-time high over $106,000 on Donald Trump’s strategic reserve plans

- Crypto.com Debuts Sports Event Trading Product

Despite the growing popularity of digital currencies, experts estimate that Bitcoin is unlikely to be purchased by the U.S. government in 2025. While Bitcoin and other cryptocurrencies continue to gain traction among investors and users, government officials remain cautious about fully embracing them for official use or as part of national reserves.

Bạn đang xem: It won’t do this in 2025

U.S. government plans to capitalize on current holdings

The U.S. adoption of Bitcoin remains still somewhat vague and unclear. Currently, the U.S. holds 183,850 BTC which is worth just over $17 billion. However, the U.S. has currently suggested no plans to increase their Bitcoin investments, preferring to capitalize on their current holdings. While the U.S saw two major events in 2024 which directly influence the expanded adoption of Bitcoin in the U.S (the launch of spot-based Bitcoin ETPs in the United States, and the election of Donald Trump for a second, non-consecutive presidential term), experts still estimate that Bitcoin will not be expanding anytime soon.

Xem thêm : The Future of Cryptocurrency Under Bitcoin’s $100,000 Valuation Milestone

“The US government will not purchase Bitcoin in 2025,” Galaxy Research head of research Alex Thorn said in a Dec. 27 report. However, Thorne estimates that the U.S. will create a stockpile using the Bitcoin they already possess while continuing conversations on a Bitcoin reserve policy. Thorne also estimates that by the end of 2025, the U.S. will pass legislation to create a formal system for regulating stablecoin issuers. Stablecoins are a type of cryptocurrency that are pegged to other assets, like commodities or fiat currency, to maintain a stable price.

“Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets,” says Thorne, “and when combined with expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption.”

Dodgecoin expected to hit $1 million

Other predictions according to Galaxy Research include that Dogecoin, a cryptocurrency known for being a “memecoin,” will finally reach a value of $1 per coin, which would push its market capitalization to $100 billion. This is a significant milestone for Dogecoin, which has been popular among cryptocurrency enthusiasts and investors, largely due to its meme origins and celebrity endorsements.

Xem thêm : ‘It is essential to empower real people’

However, they also predict that the new “Department of Government Efficiency” headed by Elon Musk and Vivek Ramaswamy will successfully identify and implement cost-cutting measures. These cuts will exceed the market cap of Dogecoin at its peak in 2025. In other words, the Department of Government Efficiency is expected to achieve cost reductions that surpass the $100 billion value Dogecoin is projected to reach.

Other nations continue to watch U.S. Bitcoin decisions

While the decisions made by the U.S. government are still being monitored by international governments, including Japan who has admitted that they are waiting to see what measures the U.S. takes with regards to cryptocurrency before making their own decisions, other nations may continue to spearhead along despite U.S. hesitancy.

Galaxy Research analyst Jianing Wu predicts that five major companies listed on the Nasdaq 100 index will announce that they have added Bitcoin to their balance sheets. In addition to this, five countries (including some potentially unaligned or adversarial to the United States) are predicted to add Bitcoin to their sovereign wealth funds. Competition may arise between nations, especially those with large sovereign wealth funds or countries that are not aligned with Western powers, as Bitcoin adoption becomes more prevalent. These nations will look for ways to mine Bitcoin or acquire it through other means, seeing it as a valuable resource for future economic and geopolitical leverage.

Bitcoin is expected to become a more widely accepted and sought-after asset by both corporations and countries, expanding beyond its current use as a speculative investment to become a more integral part of corporate balance sheets and national financial strategies.

Nguồn: https://gapinsurance.click

Danh mục: News