What is an Amortization Schedule?

An amortization schedule is a breakdown of how each payment on a loan is applied to both the interest and the principal balance. The concept of amortization involves spreading out the cost of a loan over its term, ensuring that each payment covers both interest and principal.

The components of an amortization schedule include:

– Periodic Payments: The regular payments you make on your loan.

– Interest: The portion of each payment that goes towards paying off the interest on your loan.

– Principal: The portion that reduces the outstanding balance of your loan.

– Remaining Loan Balance: The amount left to pay after each payment.

Understanding an amortization schedule helps borrowers see exactly how their payments are being used and when they will pay off their loan.

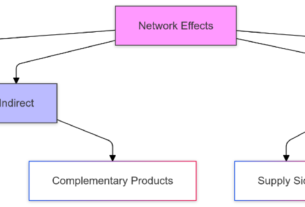

- What is Network Effect? Analyzing Value Growth in Connected Systems

- Mastering a Balanced Investment Strategy: Expert Tips for Optimal Returns

- Understanding Adjudication in Finance: Streamlining Loan Decisions and Dispute Resolution

- Comprehensive Guide to All Risks in Finance: Understanding and Mitigating Financial Risks

- Mastering Always Be Closing (ABC): The Ultimate Sales Strategy for Modern Business

How to Calculate an Amortization Schedule

Calculating an amortization schedule can be done using various tools such as financial calculators, spreadsheet software like Microsoft Excel, or online amortization calculators.

Here’s a step-by-step example for calculating an amortization schedule for a $30,000 auto loan at 3% interest over 5 years:

1. Determine the monthly payment amount using a formula or calculator.

2. For each month, calculate the interest paid by multiplying the current balance by the monthly interest rate.

3. Subtract the interest from the monthly payment to find out how much goes towards principal.

4. Update the remaining balance by subtracting the principal paid from the previous balance.

For instance, in the first month of a $30,000 auto loan at 3% interest:

– Monthly payment = $552.41

– Interest = $30,000 * (0.03 / 12) = $75

– Principal = $552.41 – $75 = $477.41

– Remaining Balance = $30,000 – $477.41 = $29,522.59

Components of an Amortization Schedule

A typical amortization schedule includes several key columns:

– Period: The number of the payment period (e.g., Month 1, Month 2).

– Beginning Loan Balance: The outstanding loan balance at the start of each period.

– Payment: The total amount paid each month.

– Interest: The portion of the payment that goes towards interest.

– Principal: The portion that reduces the loan balance.

– Ending Loan Balance: The remaining balance after each payment.

Each column provides valuable information to both borrowers and lenders, showing how much interest is being paid versus how much principal is being reduced over time.

Example of an Amortization Schedule

Let’s consider a 30-year mortgage as an example. In the early years of a 30-year mortgage, most of your monthly payments go towards paying off interest rather than principal. For instance:

– In Year 1, you might pay $10,000 in interest and only $2,000 in principal.

– By Year 20, this ratio flips; you might pay $5,000 in interest and $7,000 in principal.

This shift highlights how important it is to understand where your money is going and how making extra payments can significantly reduce total interest paid.

Benefits and Practical Uses of an Amortization Schedule

An amortization schedule is more than just a piece of paper; it’s a powerful planning tool. Here are some benefits:

– It helps you plan and manage your loan repayments effectively by showing exactly how much goes towards interest versus principal.

– It allows you to compare different loan options by seeing which one has lower total interest costs over its term.

– Making additional payments can significantly reduce both the principal balance and total interest paid over time.

For example, if you make one extra payment per year on a 30-year mortgage, you could save thousands in interest and pay off your loan years earlier.

Common Types of Loans That Use Amortization Schedules

Amortization schedules are commonly used for various types of loans including:

– Mortgages

– Car Loans

– Student Loans

– Personal Loans

Each type of loan may have different terms and conditions but understanding how amortization works remains crucial for effective management.

Tools and Resources for Creating Amortization Schedules

Creating an amortization schedule is easier than ever with modern tools:

– Financial Calculators: Specialized calculators designed specifically for financial calculations.

– Spreadsheet Software: Programs like Microsoft Excel offer templates and formulas to create detailed schedules.

– Online Amortization Calculators: Websites that allow you to input your loan details and generate schedules instantly.

Using these tools effectively involves entering accurate data such as loan amount, interest rate, and term length.

Nguồn: https://gapinsurance.click

Danh mục: Blog