- 3 Predictions for Crypto in 2025

- [Analysis] “Prospects for Improved Relations Between the Cryptocurrency Industry and Banks Under the Trump Administration”

- Frax Partners With Securitize on New Stablecoin

- 2024 was big for bitcoin. States could see a crypto policy blitz in 2025 in spite of the risks

- Global Spot Crypto Trading Climbs 142% Year-Over-Year to $2.1T

The cryptocurrency market is booming, and its growth shows no signs of slowing down. Even though there is a lot of excitement, many people are still wondering about the best time to get involved, the best way to approach it and how to prepare. Richard Teng, a CEO at Binance, has shared his thoughts, offering a different take on the hype.

Bạn đang xem: Binance CEO Gives Only Recommendation on Cryptocurrency Market

Long story short, Teng is convinced it is better to plan ahead than to act on impulse right now. His recommendation is simple: do your homework before you jump in. He says it is important to understand the market’s details and to think long term when you are considering investing. If you are tempted by quick gains, he suggests you proceed with caution and careful planning.

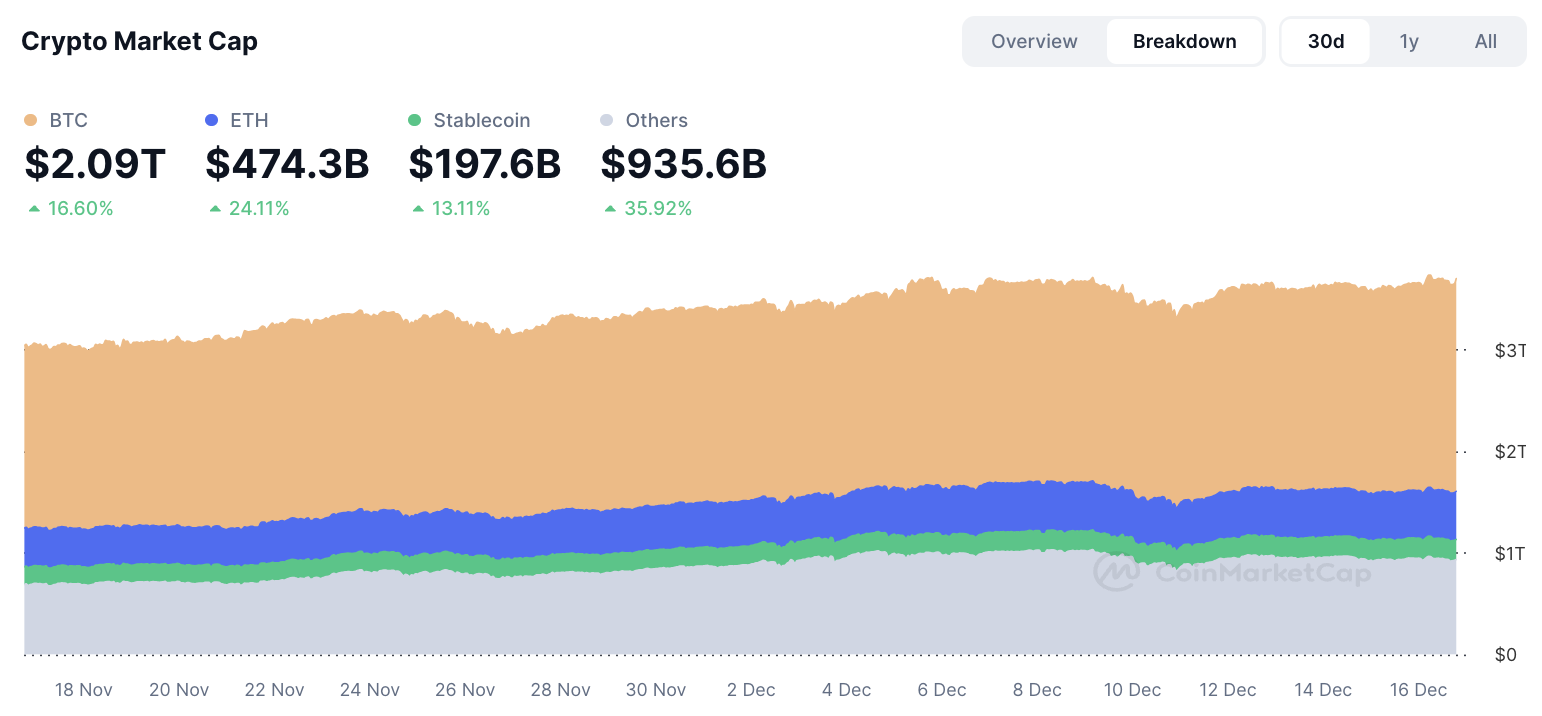

The numbers tell a pretty impressive story. In just two months, the cryptocurrency market cap — measured by the TOTAL index — has seen a 58% surge, reaching an all-time high of $3.68 trillion.

Altcoins, which exclude Bitcoin (BTC) and Ethereum (ETH), have done especially well, with their combined market cap rising 92.41% to $1.16 trillion. Even Bitcoin itself recently reached an unprecedented $106,648. These figures show how quickly the sector is growing and how attractive it is to investors, both new and experienced.

Binance running numbers as FOMO kicks in

Xem thêm : Best Cryptocurrency To Buy Now | Top 10 Crypto Coins To Invest Before Trump Presidency

Binance plays an absolutely crucial role in this ecosystem. As the first crypto exchange to surpass $100 trillion in lifetime trading volumes earlier this year, it is clear that it has a significant influence. With nearly 250 million users, $182 billion in total assets and $26.6 million in daily trading volume, the platform has a huge reach.

These achievements show not only how big Binance is in terms of operations but also that more and more people around the world are interested in digital assets.

Teng’s insights are a good reminder that rapid market growth and rising valuations come with their own risks. His advice to think ahead, not just react to market trends, reflects a broader philosophy of taking a considered approach.

Nguồn: https://gapinsurance.click

Danh mục: News