- MicroStrategy leads cryptocurrency stocks with 402% gain in 2024

- Luxury Brands May Soon Let You Pay in Cryptocurrencies

- 1 Top Cryptocurrency to Buy Before It Soars 1,500%, According to Cathie Wood

- Volatility Ahead? Massive $18 Billion Cryptocurrency Options Expiry Looms Over Crypto Market

- Singapore Emerges as Asia’s Leading Cryptocurrency Hub with Risk-Adjusted Regulations

Author: Fu Ruo, Odaily Planet Daily

In 2024, the investment and financing heat in the crypto field decoupled from the overall market trend, with VC coins no longer dominating market performance.

On a macro level, the crypto market in 2024 welcomed numerous historical moments, including the launch of Bitcoin spot ETFs, the launch of Ethereum spot ETFs, the clarification of regulatory policies in various countries, the Federal Reserve’s announcement of interest rate cuts, and Trump’s impending return to the White House, all of which positively impacted the market, leading Bitcoin to successfully break through the important threshold of $100,000.

Internally, the crypto market saw meme coins become the focus of attention, with different types of memes at different times serving as boosters for market rallies. VC projects performed poorly, and the linear release cycle of tokens became a chronic “poison” for VC projects.

Under the influence of various factors, the number of financing activities in the primary market increased significantly, but the amount of financing was more cautious.

Looking back at the investment and financing activities in the primary market in 2024, Odaily Planet Daily found:

- In 2024, the number of financing activities in the primary market was 1,295, with a disclosed total financing amount of $9.346 billion;

- The AI sector showed its strength, with a surge in financing activities in Q4 2024;

- The largest single investment amount was $525 million for Praxis.

Note: Odaily Planet Daily categorized all projects disclosed in Q1 based on dimensions such as business type, target audience, and business model into five major tracks: Infrastructure, Applications, Technology Service Providers, Financial Service Providers, and Other Service Providers. Each track is further divided into different sub-sectors, including GameFi, DeFi, NFT, Payments, Wallets, DAO, Layer 1, Cross-chain, and others.

In 2024, it belongs to BTC and meme coins

An overview of the primary market financing situation over the past three years leads to an important conclusion: The investment and financing activities in the primary market in 2024 have gradually decoupled from the overall trends of the crypto market, with market conditions primarily driven by Bitcoin and meme sectors, while traditional VC projects performed poorly and could no longer serve as the core driving force of the market.

From data analysis, 2022 was the peak period of the previous crypto market cycle, with primary market financing activities highly active, and the changes in quantity and amount almost synchronized with market conditions. In Q1 2022, the number of financing activities reached 562, with an amount as high as $12.677 billion. However, as the market entered a downward cycle, financing activities rapidly contracted, with only 330 financing activities remaining in Q4, and the amount dropping to $3.375 billion.

Xem thêm : Bitcoin surges past $107,000 on hopes for US strategic reserve | Crypto News

2023 continued the bear market effect, with financing activities in the primary market and the overall market performing poorly. The number and amount of financing continued to decline throughout the year, dropping to 232 and $1.725 billion in Q3, marking a nearly three-year low. During this phase, the primary market was significantly affected by the overall market trends, with market sentiment and capital activity both suppressed.

2024 became an important turning point for investment and financing activities in the primary market. Data shows that the number of financing activities rebounded significantly, with Q1 2024 reaching 411, an increase of nearly 69% compared to Q4 2023. However, in contrast to the rebound in the number of financing activities, the amount of financing remained cautious, with quarterly total financing amounts hovering between $1.8 billion and $2.8 billion throughout the year. This indicates that although capital activity has somewhat recovered, investors are more conservative in their funding commitments, further indicating the decoupling nature of the primary market from the overall market.

From the distribution of market heat, the crypto market in 2024 is dominated by Bitcoin and meme sectors, which sharply contrasts with the performance of the previous cycle. In the previous cycle, VC projects were typically at the core of market hotspots, while in 2024, VC projects overall performed poorly and could no longer have a substantial impact on the market. This phenomenon has diminished the value of the primary market as a reference indicator for overall market trends.

The primary market in 2024 exhibits a trend of rationalization and independence. After experiencing the frenzy of 2022 and the winter of 2023, investors are evidently more cautious, focusing more on the actual quality and long-term value of projects rather than blindly chasing market hotspots. This change may indicate that the primary market is gradually detaching from traditional crypto market cycles and entering a new stage of development.

The increase in the number of financing activities and the cautious amounts reflect that VC institutions are more inclined to diversify their investments and are more conservative in capital allocation. This attitude suggests that the return of market heat has not led to a large-scale influx of capital but has prompted investors to pay more attention to projects that truly possess potential. In other words, the primary market is no longer just a “follower” of market trends but is beginning to play a role in shaping the future market landscape.

In 2024, the primary market had 1,295 financing activities, with a disclosed total financing amount of $9.346 billion

According to incomplete statistics from Odaily Planet Daily, in 2024, there were a total of 1,295 investment and financing events in the global crypto market (excluding fund-raising and mergers), with a disclosed total amount of $9.346 billion, distributed across infrastructure, technology service providers, financial service providers, applications, and other service providers. Among these, the application track had the highest number of financing activities, totaling 606; the infrastructure track had the highest financing amount, totaling $3.976 billion. Both led other tracks in terms of financing amount and quantity.

From the above chart, the application track, being the area of the crypto industry closest to end users, has always been the focus of the primary market. In 2024, the financing performance of the application track achieved double growth compared to 2023, with the number and amount of financing increasing by approximately 20%.

The financing performance of the infrastructure track in 2024 was particularly remarkable. Both the number and amount of financing increased significantly compared to 2023, with an increase of over 50%. This growth is driven not only by the ongoing demand for continuous upgrades of underlying technical facilities in the crypto industry but also by the rise of emerging fields such as AI (Artificial Intelligence) and DePIN (Decentralized Physical Infrastructure Networks), bringing new development opportunities to the infrastructure track.

Overall, the investment and financing activities in the global crypto market in 2024 exhibit distinct characteristics, with the application track and infrastructure track leading in both quantity and amount, indicating a dual demand from the market for end-user experience and underlying technology upgrades. Meanwhile, technology service providers, financial service providers, and other service provider tracks are brewing new opportunities in stable development, especially the financial service provider track, which is expected to see new breakthroughs in 2025 as mainstream finance enters the space.

The AI sector shows its strength, with a surge in financing activities in Q4 2024

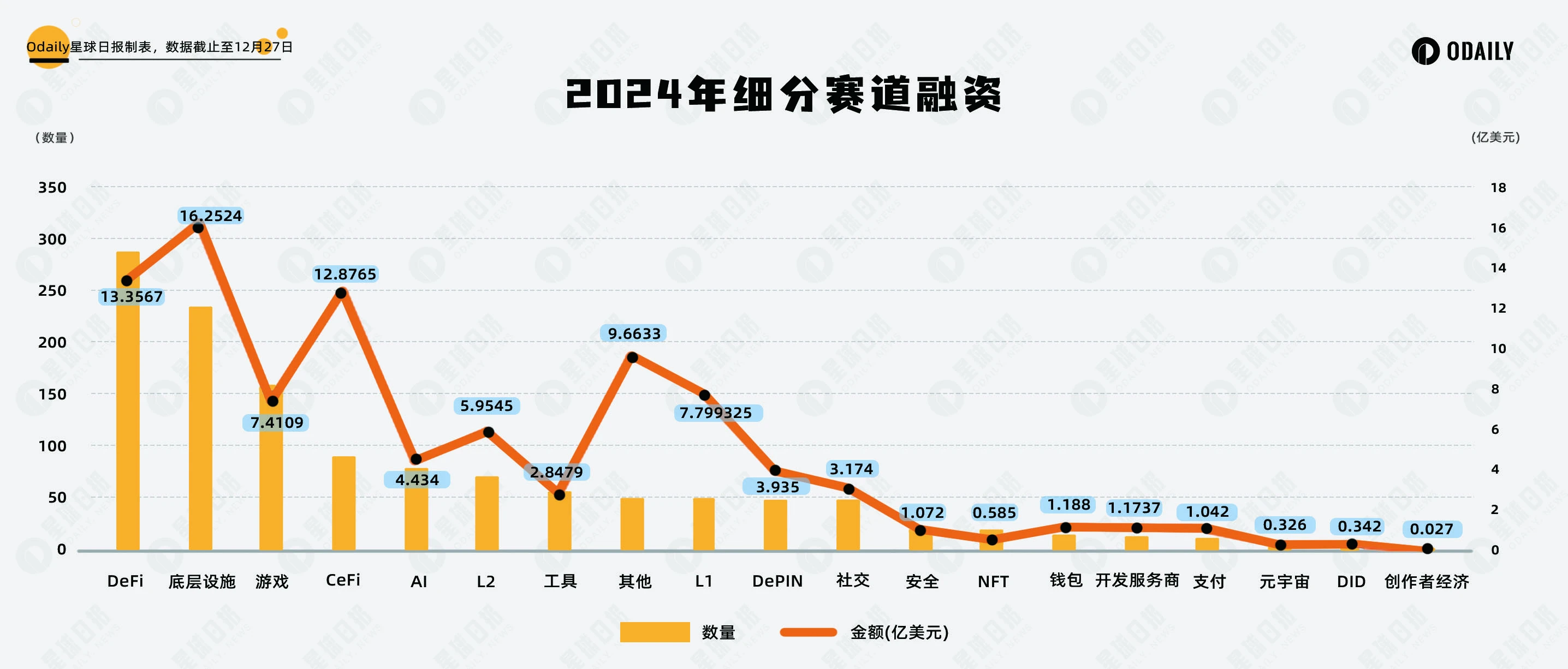

According to incomplete statistics from Odaily Planet Daily, in 2024, financing events in the segmented tracks were concentrated in DeFi, underlying infrastructure, and gaming, with DeFi having 289 activities, underlying infrastructure having 236 activities, and GameFi having 160 activities.

From the distribution of financing activities in sub-tracks:

Throughout 2024, the DeFi and underlying infrastructure sectors continued to maintain stable growth, with both total financing volume and quantity ranking at the top. This indicates that the market’s demand for decentralized finance and underlying technology remains strong, whether it is the innovation of new protocols in DeFi or the ongoing optimization of underlying infrastructure such as multi-chain interoperability and blockchain security, all of which have become focal points for capital.

In contrast, the gaming sector performed impressively in the first three quarters, consistently ranking among the top three in terms of financing activities, but experienced a noticeable decline in the fourth quarter, with only 29 projects disclosing financing information. This trend reflects a phase-wise weakening of GameFi’s popularity, with the market becoming more cautious about its short-term profitability and user growth prospects.

At the same time, the AI sector’s popularity has rapidly risen, becoming a major highlight of 2024. This track initially developed alongside other fields (such as DeFi and infrastructure) and was not separately categorized. However, starting in Q3, the AI sector gradually emerged, especially in Q4, where both the number and amount of financing doubled. The market has shown high interest in the application potential of AI + blockchain, and the rise of AI Agents has further ignited capital enthusiasm for this track.

The largest single investment amount was $525 million for Praxis

From the list of the top 10 financing amounts in 2024, it can be seen that despite fluctuations in the market environment, investment institutions remain confident in infrastructure projects. The top ten projects are almost all focused on underlying technology and innovation directions, demonstrating institutions’ high expectations for the future development of this track.

L1 public chains continue to attract large-scale financing. On the list, in addition to the established public chain Avalanche completing a $250 million private placement, emerging projects such as Monad, Berachain, and Babylon also showed strong growth momentum. These projects have garnered investor attention through technological innovation and ecosystem expansion.

Praxis is the financing champion on this list, receiving as much as $525 million in investment. However, the specific development direction of this project remains relatively vague, primarily managed in a DAO organizational format, with entry into the DAO requiring an application, limiting the disclosure of related information.

It is noteworthy that Paradigm’s dominant position on the list is evident. As a top venture capital institution, Paradigm led investments in three major projects on the list—Monad, Farcaster, and Babylon.

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.

Nguồn: https://gapinsurance.click

Danh mục: News