- Bitcoin Surges Back Above $100,000

- Onchainpay: Revolutionizing Business Payments with Cryptocurrency

- This Cryptocurrency’s Unique Technology May Revolutionize Decentralized Applications

- Singapore Emerges as Asia’s Leading Cryptocurrency Hub with Risk-Adjusted Regulations

- 120% growth! Bitcoin outperformed most asset classes last year — will the momentum sustain for cryptos in 2025?

A recent Emerson College survey has highlighted the growing intersection between cryptocurrency and American voters.

Bạn đang xem: 1 in 5 US Voters Engaged with Cryptocurrency, Emerson College Poll Reveals

Conducted from December 11–13, the poll revealed that around 19% of registered voters in the United States have engaged with cryptocurrencies through investment, trading, or usage. Notably, nearly 40% of these individuals have made purchases using digital assets, underscoring the increasing utility of cryptocurrency in mainstream financial ecosystems.

Crypto Constituency: A Diverse and Youthful Demographic

The survey underscores the demographic diversity within the cryptocurrency user base. Spencer Kimball, Executive Director of Emerson College Polling, noted, “Crypto users are younger and have a larger minority base, highlighting crypto as a growing, diverse constituency for political support.”

Crypto thrives among voters under 40, with usage dropping sharply as age increases. Source: Emerson College Polling

Xem thêm : Week in RWA: Sector Suffers Major Blow Following Bitcoin Sell-Off

Young voters dominate the crypto space, with approximately one-third of individuals under 40 reporting some form of crypto engagement. Usage rates decline significantly among older demographics, with 28% of those in their 40s, 17% of those in their 50s, and just 4% of voters over 70 having interacted with digital currencies. Gender disparities were also evident in the findings, as men were twice as likely to use crypto compared to women—26% of men versus 13% of women reported cryptocurrency usage.

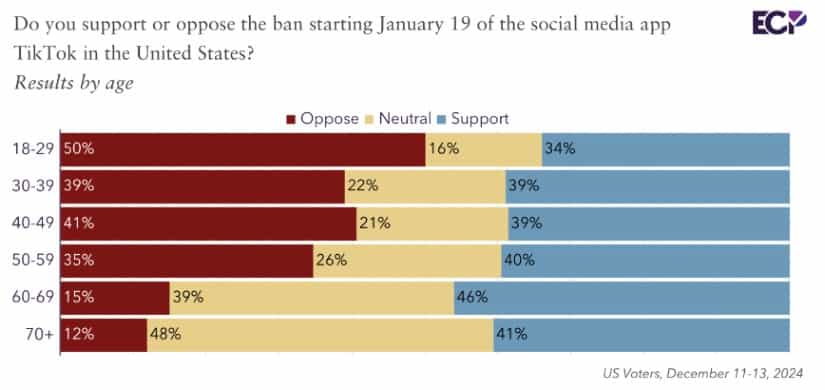

40% of Emerson poll respondents back a TikTok ban. Source: Emerson College Polling

The survey also revealed higher adoption rates among minority communities. About one in three crypto users identified as Asian, Hispanic, or Black, while only 14% of users were white. This is indicative of a broader trend wherein cryptocurrency brings financial inclusion for historically underrepresented groups. In giving access to decentralized financial tools, cryptocurrency seems to level the field in favor of those highly underserved by traditional banks.

Cryptocurrency’s Growing Political Influence

Cryptocurrency is not just a financial tool but is now emerging as a serious political force. The Emerson poll shows that 57% of cryptocurrency users hold favorable views of President-elect Donald Trump, who has been the most vocal about his support for the digital asset sector. During his campaign, Trump came out with a pro-crypto policy and nominated several crypto-friendly individuals into key financial regulatory positions, including the SEC.

Xem thêm : Elon Musk Adjusts Ambitious $2 Trillion Budget Cut Plan

A separate survey by the Digital Chamber estimated that 26 million American voters form a “crypto voting bloc,” prioritizing pro-crypto policies when choosing candidates. This burgeoning voter segment could shape future election strategies, as political candidates increasingly target this tech-savvy demographic.

Crypto PACs Fuel Election Campaigns

Political Action Committees have also magnified cryptocurrency’s influence in elections by pumping immense resources into pro-crypto candidates. For instance, Fairshake PAC reportedly spent tens of millions during the 2024 election cycle to back crypto-supportive candidates from both parties. High-profile industry figures such as Ripple co-founder Chris Larsen and the Winklevoss twins have also been pivotal in funding these campaigns.

That support has grown, enhancing the presence of pro-crypto candidates, many of whom currently fill key legislative and regulatory roles that will likely shape policies favorable to the cryptocurrency sector in the years to come.

A Regulatory Shift on the Horizon?

There may be a new era of regulatory clarity and support for the blockchain and cryptocurrency businesses in the United States, as seen by the growing influence of pro-crypto voices in government. According to observers, the current administration may be the most crypto-friendly in American history, opening the door for innovation and broad adoption.

With the regulators and the industry leaders working together, a changing regulatory environment can eventually provide the cryptocurrency industry with much-needed stability. Advocates say balanced regulations would help to increase institutional investment, inspire innovation, and establish the United States as a leader in blockchain technology globally.

Nguồn: https://gapinsurance.click

Danh mục: News