What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining

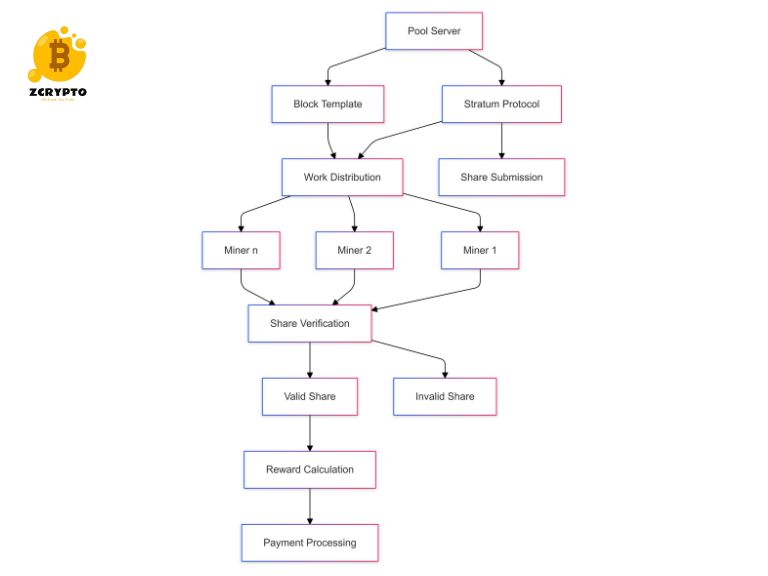

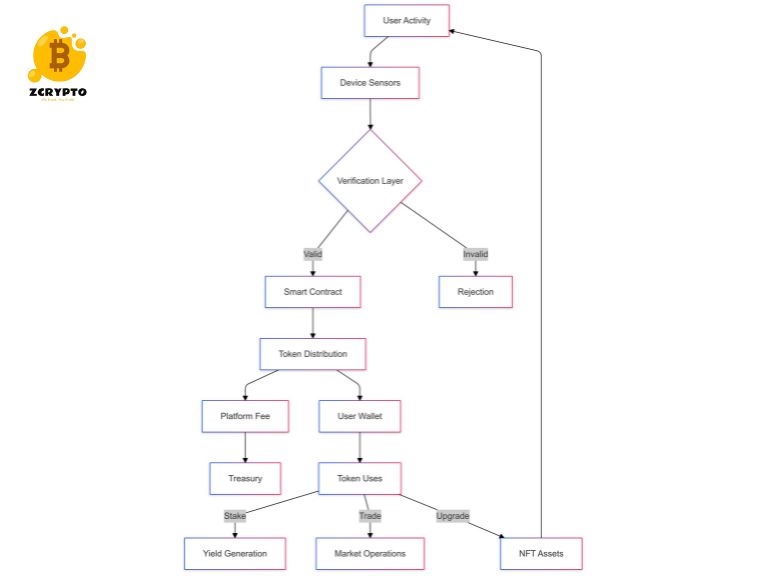

Mining pools represent a critical infrastructure component in cryptocurrency networks, enabling multiple participants to combine their computational resources for more predictable block rewards. This technical analysis examines the core mechanisms, operational frameworks, and economic dynamics of mining pools in cryptocurrency networks. What is Mining Pool? A Technical Analysis of Collaborative Cryptocurrency Mining. Technical Architecture of […]

Continue Reading